What Makes The Indian Stock Market The Most Attractive Investment

Unlocking Investment Opportunities in a Vibrant Economy

Explore the dynamic landscape of India's stock market, offering insights into its growth, key exchanges, and investment potential. Discover how the country's expanding middle class, young population, and robust economy shape its financial outlook.

The Indian stock market is often regarded as one of the most appealing investment opportunities.

Here are a few reasons why:

Economic Growth

Diverse Investment Options

Regulatory Framework

Increasing Foreign Investment

Technological Advancements

India is the world's most populous country and one of the fastest-growing economies. This growth translates into:

More companies are coming up,

Expansion of existing companies,

Foreigners show interest

The demand for consumer goods, pharmaceuticals, and automobiles is escalating, driven by the country's expanding middle class and growing disposable incomes. Sectors closely linked to consumer needs, such as banking, travel, and services, are also witnessing significant growth.

India boasts six stock exchanges, facilitating the trading of securities and providing investment opportunities:

Bombay Stock Exchange (BSE)

National Stock Exchange (NSE)

Metropolitan Stock Exchange of India Ltd. (MSEI)

Multi Commodity Exchange of India Ltd. (MCX)

National Commodity & Derivatives Exchange Ltd. (NCDEX)

Indian Commodity Exchange Ltd. (ICEX)

NSE and BSE Performance:

In 2024, the National Stock Exchange (NSE) had 2,379 listed companies with a market capitalisation of ₹3,80,85,72,106.01.

The Bombay Stock Exchange (BSE) had 5,505 listed companies with a market capitalisation of ₹47,596,283.68.

The Indian stock market offers a growing range of sectors and industries, allowing investors to diversify their portfolios effectively. The benchmark index, the Sensex, has shown remarkable growth, surging from around 30000 to over 80000.

It is no wonder, given the growth of India’s economy and population size. Similarly, the number of bank accounts in India has soared to more than 200 million, significantly surpassing the population of many countries.

This was inevitable. 2014 there were 7,000 passenger trains; today, there are more than 13,000 trains. More than 23 million people travel by train at any given time. This metric alone indicates the magnitude of engineering, science, technology, economics, HR, trade, commerce, and legal subjects—subjects we read in our school textbooks and questions asked in exams—that must have gone into it. You may also include political science and literature subjects in this list.

Human growth can not be ceased. This is aptly reflected in a country’s stock market. With its burgeoning population and rapidly expanding economy, India has emerged as a global economic powerhouse. This growth has led to several notable developments in the country's business landscape:

India's vibrant economy and rising population have catalysed the growth of its stock market, making it an attractive investment destination for both domestic and foreign investors. This growth is a testament to the resilience and potential of the Indian economy and its ability to create opportunities for businesses and investors alike.

The Indian stock market's combination of economic potential, regulatory support, and technological accessibility makes it an attractive option for investors.

The market has a well-established regulatory framework, which provides security for investors and helps maintain market integrity. With a surge in foreign direct investment (FDI), the Indian market is increasingly attracting global investors, which can enhance liquidity and market stability. The rise of online trading platforms has made investing in the stock market more accessible, enabling a broader range of investors to participate.

As a long-term investor in the Indian equity markets, clearly understanding your investment rationale is crucial. A well-defined logic helps you stay committed to your investment plan and avoid being swayed by short-term market fluctuations.

Simplicity is critical when it comes to investment reasoning. Many large investors, particularly foreign investors, have a straightforward reason for investing in India. Their reasoning is based on two fundamental factors: India's GDP and its young population.

India's GDP and Long-Term Growth Potential:

India's GDP currently stands at approximately $3.4 trillion.

Over the long term, India's nominal GDP is projected to grow at a rate close to 10% annually.

This growth rate is significant and provides attractive investment opportunities.

Young Population and Demographic Dividend:

India has a median age of around 28 years, considerably lower than other major economies.

A younger population means a larger working-age population, leading to higher productivity and economic growth.

This demographic dividend is expected to contribute to India's sustained economic expansion in the coming years.

These two factors—India's GDP growth potential and its young population—form the basis of the investment logic for many large investors in India. The rationale is simple: India's economy is poised for long-term growth, driven by a large and productive workforce. By investing in the Indian equity markets, investors can potentially benefit from this growth and generate attractive returns over time.

A younger demographic implies a higher propensity for individuals to engage in upskilling endeavours, demonstrating a desire for increased earning potential and consumption. The average Indian citizen has yet to acquire significant assets such as a private automobile or residential property. Furthermore, the consideration of marriage and the subsequent decision to provide higher education for one's offspring are not immediate concerns.

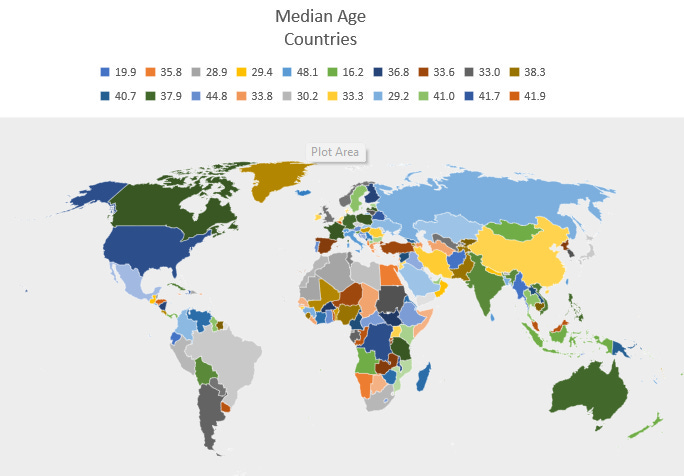

Here are the median ages for some countries in 2024 (years):

World: 30.6

India: 28.4

United States: 38.3

Asia: 32.1

Tajikistan: 22.1

Ukraine: < 43

Belarus: < 43

Here are some of the top countries by GDP in 2024 ($ trillion):

United States: 25.43

China: 14.72

Japan: 4.25

Germany: 3.85

India: 3.41

United Kingdom: 2.67

France: 2.63

Russia: 2.24

Canada: 2.16

Italy: 2.04

India's GDP is expected to grow by 6–7% in 2024–25. In 2024, its GDP per capita is estimated to be $2,698 (nominal) and $11,112 (PPP).

The median age is a valuable statistical indicator, dividing a population into two equal groups based on age. It provides insights into a society’s demographic makeup, with half the population being older and the other half younger than the median age. Governments and businesses extensively utilise this statistic for planning, as it helps them anticipate the population's demand for various goods and services.

A younger population often signifies a higher propensity for personal and professional growth. Individuals in this demographic are more likely to engage in upskilling, aiming to enhance their knowledge, skills, and qualifications. This increases earning potential, disposable income, and the desire to spend. For instance, many young Indians aspire to purchase their first car or house, consider marriage, and plan for their children's education. These life goals create significant demand for various products and services, driving economic growth.

In contrast, countries with rapidly ageing populations face unique challenges. As more people retire, the proportion of individuals actively contributing to the economy diminishes. This demographic shift can strain public finances, healthcare systems, and social security programs. Additionally, a smaller workforce may impact economic productivity and growth.

However, India stands out with its predominantly young population, offering immense potential for economic prosperity. As "Young India" progresses through various life stages, their earning power and consumption are expected to rise substantially. This presents lucrative opportunities for businesses that cater to their evolving needs. Investors who allocate their funds to a diversified portfolio of quality companies poised to benefit from this demographic dividend stand to reap significant rewards.

While stock markets may exhibit volatility due to various factors, the long-term outlook for India's equity markets remains positive. Supported by a young and vibrant population, the Indian economy is well-positioned for sustained growth. Historically, stock market returns have outperformed other asset classes over the long term, and this trend is likely to continue as India's young population drives economic expansion.

Tags: Indian Stock Market, Economic Growth, Investment Opportunities, Bombay Stock Exchange, National Stock Exchange, Sensex, Foreign Direct Investment, Demographic Dividend, GDP Growth